Total Lubmarine OEM Relationship Manager, Nikolaos Kotakis, discusses the technical lubricant challenges that the upcoming IMO 2020 regulation presents to operators, exploring Total’s solutions and services that cover all routes to compliance.

THE CHALLENGES

The International Maritime Organization (IMO) 2020 Sulfur Cap presents operators with three key challenges: cleanliness, avoiding engine wear and ensuring Tier 3 compliance.

For lubricants, there are three main issues to address. First, the selection of the correct lubricant, including the right cylinder oil for two-stroke engines. Second, managing a potentially increased range of lubricants on board the vessel, and finally, to adopt the correct monitoring approach.

There is then the strategy of dealing with the 2020 transition as we enter the final part of 2019. Over the coming weeks, the fuel switch needs to take place; the tanks need to be cleaned and operators need to make sure that the fuel treatment system onboard is working to the highest possible levels of efficiency.

MAKING YOUR TWO-STROKE CHOICE

There are three main paths to IMO 2020 compliance in terms of fuel choice.

The first is straightforward. As of 2020 ship operators use the 0.5% compliant Very Low Sulfur Fuel Oils (VLSFO) and in Emission Control Areas (ECAs), the 0.1% Ultra Low Sulfur Fuel Oils (ULSFO). This is the scenario most operators have initially opted for.

In the weeks leading up to the new regulation, as well as the early months of implementation, we will see many ship operators acting more cautiously, keeping a close eye on cleanliness issues as recommended by the OEMs. Here, Total provides TALUSIA UNIVERSAL (BN 57). Universal provides the right balance between higher detergency and BN, without raising it to the level where there would be negative side-effects from calcium deposits on the engine. This is our recommended solution for the transition period and as a premium product for demanding engines from 2020 onwards. It is important to note that the market might also expect a BN 40 product. Should our customers choose this route, we have a solution in TALUSIA LS 40 that received an approval letter in June 2019.

The second option is to install a sulfur abatement technology (scrubber). A scrubber is compliance through forward-weighted capital investment. The hope of the operator is that it will significantly reduce the longer-term operational expenses by continuing to use the cheaper HSFO. Today, the average sulfur content in HSFO is about 2.4-2.6%. However, if we assume that the lowest part of this will be used to blend 0.5% sulfur fuel, the average left for blending HSFO for scrubbers will rise. With this in mind, the key products we offer are the TALUSIA UNIVERSAL 100 (BN 100) and the TALUSIA OPTIMA (BN 100). While both are a BN 100 product, they are two different formulations, with different philosophies and performances. This said Total will also continue to provide the traditional BN 70 and a higher BN 140 product. Ultimately, the correct product will all depend on the specific engine, and Total will work with operators to find the right solution.

The third option is Liquefied Natural Gas (LNG) dual-fueled engines. LNG, as bunker fuel, is a solution supported by Total Group, whose investment from production to end-user, makes them the second-largest player in the world. When we talk about this option from a lubricant perspective, we must consider both the LNG and cylinder oil components. For this, we have the TALUSIA 25 (BN 25) product, as recommended by the OEMs. However, when cleanliness is a significant concern, it is also worth discussing TALUSIA UNIVERSAL. Before the end of the year, Total will have completed its tests of TALUSIA UNIVERSAL with an LNG fueled vessel to ensure our customers have all options available. There is also potentially a third option: TALUSIA OPTIMA. This final solution has been designed to cover all routes to compliance; providing operators with maximum flexibility.

MONITORING IS CRUCIAL

As far as the lubricating oil is concerned, two important service letters issued by the OEMs must be factored in. The first is MAN 2019 671. This letter explains which are the right BN levels and feed rates to use. The second one is the 2019 03 letter issued by WinGD, which again focuses on the BN levels, cylinder oils and feed rates.

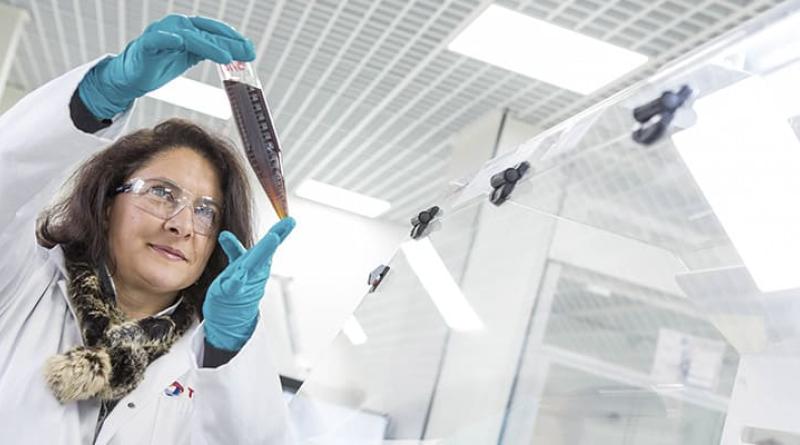

Both letters recommend the regular monitoring of the engine. This means visually inspecting the engines and undertaking detailed analysis, notably drain oil analysis. As a result, we need long term monitoring programs and the operators need to be able to adapt and optimize their feed rate.

Monitoring will be vital. This is because the operator is now the sole entity responsible for ensuring the right cylinder oil is used at the right feed rate. Total can support ship operators with monitoring solutions. Through our DIAGOMAR PLUS service, we can run drain oil reports. These reports are combined with the vessel data from the crew, through the vessel reporting form, filled out at the time of the sampling, and the fuel oil analysis, which operators can provide us. Through these, we can provide our customers with three levels of monitoring service.

These services include DRAIN OIL STANDARD, which provides an easy-to-read spot analysis to quickly identify lubrication issues, DRAIN OIL ADVANCED, which records the long-term trends of all the relevant information about the condition of the two-stroke engine within a unique user-friendly report, and finally, DRAIN OIL OPTIMIZE, which takes a holistic view of the two-stroke engine lubricant oil feed rate in combination with the lubrication performance. In short, monitoring cannot be underestimated, it is key for a smooth transition and for optimizing cost management in the longer term.

FOUR-STROKE FOCUS

When addressing four-stroke, there are three engine types to consider: traditional diesel engines, dual-fueled engines and engines running solely on gas. Each of these has its own distinct challenges.

For the regular diesel engines, we see again that there is a trend for the Tier 3 engines to be equipped with catalysts in order to meet the NOx regulation: scrubbers are also an option here. For dual-fuel engines, which can be sensitive to deposits, there needs to be adequate lubricant detergency. Finally, the gas engines require particular low-ash lubricants because the way the combustion takes place is different.

In the transition period before 2020, we will see a switch from today’s BN 30 to BN 55 range to a lower BN 15 to BN 20 spread. Based on the engine separation, for 2020, Total has worked on a brand-new trunk piston oil formulation. This engine oil formulation fulfills many objectives, but fundamentally, it ensures flexibility across our whole BN range. From BN 15 up to 50, there is a common formulation that allows operators to always have the right, and compatible, product in the right place for the fuel that they are using.

When discussing specific solutions, as in the two-stroke scenario, we have a compliant set of products: DISOLA 15 and AURELIA 20. In the HSFO, scrubber fitted scenario, the recommendation is the high BN range of 30, 40 and 50. Finally, in the gas engine category, which, for the time being, is a niche market, we have two Society of Automotive Engineers (SAE) approved products AURELIA LNG 40 and 50, something that Total is the only oil major to offer.

It is our belief that operators should be able to have all options available and whichever route to compliance taken, Total is ready.