Following its acquisition of Engie’s upstream LNG assets, the Total Group is now the second-largest player in the liquefied natural gas (LNG) market. The Total LNG portfolio includes participating interests in liquefaction plants, notably, the interest in the Cameron LNG project in the US, long-term LNG sales and purchase agreements, an LNG tanker fleet, as well as access to regasification capacities in Europe.

Natural gas has less of an impact than coal for power generation and is ideally suited as a complement to renewable energies, making it an increasingly popular energy source. In line with its commitment to adjusting its portfolio to meet the challenges of climate change, while supporting growing global demand for energy, Total is present across the entire natural gas chain, with a particular focus on LNG, a solution that makes transporting gas by ship easier.

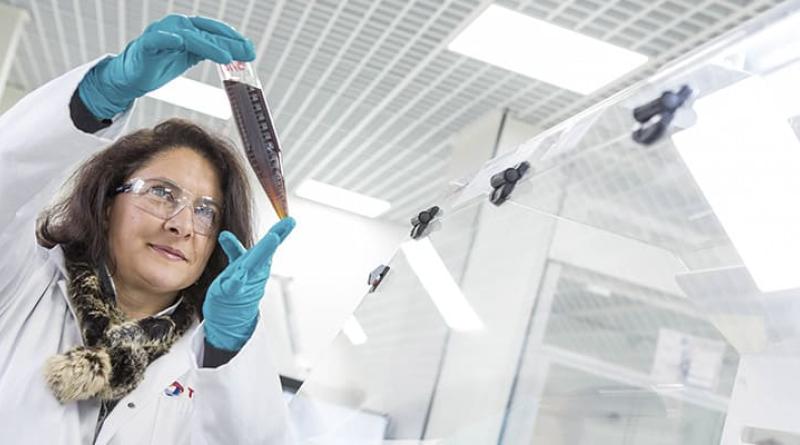

With a growing trend towards vessels using LNG as a marine fuel, and, as ship operators opt for this route to meet the 2020 global sulfur cap deadline, Total Lubmarine has ensured that it has a range of dedicated LNG lubricants. These include the TALUSIA range, specifically OPTIMA, an innovative BN 100 marine cylinder lubricant suitable for all fuels, including LNG, with a sulfur range of 0.0% to 3.5%. Thanks to its innovative formulation, using Ashfree Neutralizing Molecules (ANM), it provides superior acid neutralization and outstanding cylinder cleanliness, exceeding the capability of conventional BN 100 lubricants. In addition to OPTIMA, Total Lubmarine offers TALUSIA LS 25, which is dedicated to ECA fuels.

These products are now supported by a no objection letter (NOL) from both MAN Energy Solutions and WinGD (Wärtsilä) for use with their entire two-stroke engine range.

Total LNG portfolio by 2020:

- A total volume of LNG managed of 40 MT/year.

- A liquefaction capacity portfolio of 23 MT/year, well distributed among the major LNG production areas: Middle East, Australia, Russia and the United States.

- A worldwide LNG trading contracts portfolio of 28 MT/year to supply each LNG market with competitive and flexible resources.

- A role of a key supplier for the European market with regasification capacities of 18 MT/year.

- A fleet of 18 LNG carriers, of which 2 FSRUs (floating storage and regasification units).

Click here to read an overview of our activities in the LNG sector.